The select committee will present its report in the Lok Sabha on the first day of the next session. The new Income Tax Bill was approved in the Union Cabinet meeting on Friday. The new bill was announced by Finance Minister Nirmala Sitharaman in her budget speech on February 1. The new bill will replace the six-decade-old Income Tax Act 1961.

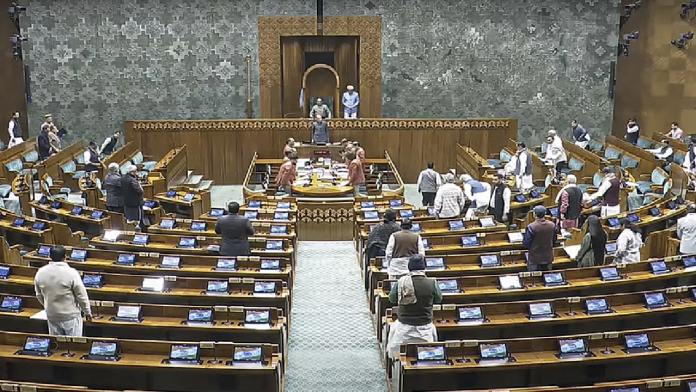

The new Income Tax Bill (Income Tax Bill, 2025) was introduced in the Lok Sabha on Thursday. Finance Minister Nirmala Sitharaman introduced the bill in the House. A proposal was also presented to send the bill to the Select Committee of the Lok Sabha. The committee will present its report in the Lok Sabha on the first day of the next session. After the bill was introduced, the proceedings of the House were adjourned till March 10. The new Income Tax Bill was approved in the Union Cabinet meeting on Friday (7 February).

Some opposition members, including Trinamool Congress’ Saugata Roy, opposed the introduction of the bill in the House. The Finance Minister introduced the bill in the House amid objections from the members and requested Lok Sabha Speaker Om Birla to send it to the Select Committee of the House.

The new bill was announced by Finance Minister Nirmala Sitharaman in her budget speech on February 1. The new Income Tax Bill, which replaces the six-decade-old Income Tax Act 1961, will make direct tax laws easier to read and understand, remove ambiguity and reduce litigation.

FY-AY will end

Once enacted, the bill will replace the six-decade-old Income Tax Act, 1961. The earlier law has become complex over time and after various amendments. In the new law proposed by the government, the term Previous Year (FY) mentioned in the Income Tax Act, 1961 has been changed to Tax Year. Along with this, the concept of Assessment Year (AY) has been abolished.

The Income Tax Bill, 2025 contains 536 sections, which is more than the 298 sections of the current Income Tax Act, 1961. The current law has 14 schedules which will increase to 16 in the new law. The number of chapters in the new Income Tax Bill has also been kept at 23. While the number of pages has been reduced significantly to 622, which is almost half of the current bulky Act, which includes amendments made in the last six decades.

How will the new law be simpler?

The Income Tax Act, 1961 deals with the imposition of direct taxes – personal income tax, corporate tax, securities transaction tax, gift and wealth tax among others. The Act currently has about 298 sections and 23 chapters. Over time, the government has abolished various levies including wealth tax, gift tax, fringe benefit tax and banking cash transaction tax.