ITR Filling Process It is very important to select the correct ITR form while filing ITR. If you do not select the correct return form, you may receive a notice from the department. Actually, the form should be selected on the basis of income source and tax slab. Today we will tell you which ITR form you should select. Read the full news…

How to File ITR: The last date for filing Income Tax Return is 31 July 2024. By the way, taxpayers have enough time to file returns.

But, if you are filing return ( ITR filling ) for the first time then you must know which ITR form is right for you.

Taxpayers must know the difference between ITR Form 1 and ITR Form 2. Actually, ITR form is selected according to the income and tax slab. A total of 6 types of ITR forms are filled in income tax, but ITR1, ITR2, ITR3 and ITR4 are very important among the ITR forms.

Let us know which taxpayer should fill which ITR form.

ITR Form-1

ITR Form-1 is a very simple form. Most salaried persons use this form to file returns. ITR Form-1 is used by those taxpayers whose income source is salary, pension, home assets and any source.

Also Read: Air India will introduce premium economy class on select domestic routes

Keep one thing in mind that taxpayers whose salary is more than Rs 50 lakh cannot use ITR Form-1. At the same time, if the agricultural income is more than Rs 5 thousand, then also Form-1 cannot be used.

ITR Form-2

Taxpayers with income more than Rs 50 lakh fill ITR Form-2. This form is used by taxpayers who have invested in non-listed equity shares or whose income comes from capital gains.

If a taxpayer’s income is from property assets, foreign assets, then also he will use this form. Let us tell you that many salaried persons and pensioner taxpayers also use this form.

ITR Form-3

ITR Form-3 is used only by those taxpayers who earn from business or any other profession. If you run even a small business, then you will have to use ITR Form-3. Apart from this, freelancers also have to fill ITR Form-3.

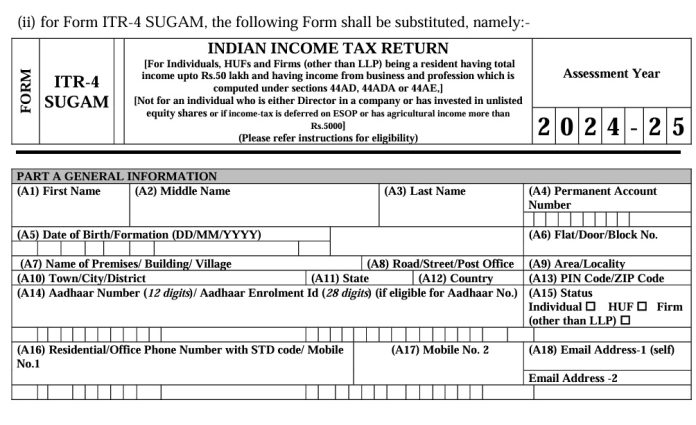

ITR Form-4

ITR Form-4 is used by those businessmen whose income ranges from Rs 50 lakh to Rs 2 crore. ITR Form-4 is also considered a very famous form.

What happens if I fill the wrong ITR form?

Now the question arises that what will happen if we fill the wrong ITR form by mistake? If we file the return on ITR Form 2 instead of ITR Form 1, then the work of filing the first return will not be completed.

It is also possible that you may receive an Income Tax Notice from the Income Tax Department. For this reason, tax experts also advise that one should always choose the correct ITR form.