In the financial year 2020-21, the government started the new tax regime. Under this, the number of slabs for deduction of tax was increased slightly, but the tax rates were reduced. However, most of the deductions have been removed in the new system.

If we talk about this year i.e. financial year 2023-24, then this time those who choose the new tax regime will not be charged any tax up to Rs 7 lakh. Even though the government has given you tax exemption in the new tax system on salary up to Rs 7 lakh, but even if your salary is up to Rs 7.80 lakh, you are still going to benefit in the new tax system.

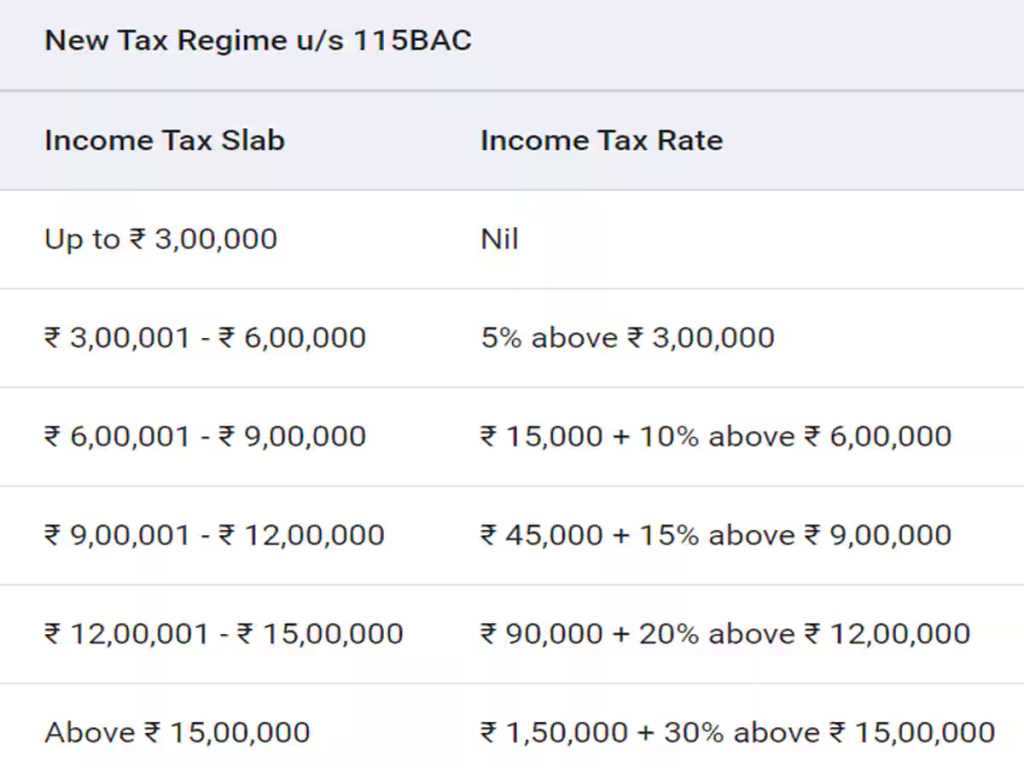

First know what is the tax slab

The government has made some changes in the last year’s budget to make the new tax system more attractive than the old tax system. Under this, you do not have to pay any tax up to Rs 3 lakh. On the other hand, if your taxable income is up to Rs 7 lakh, then you will also get tax exemption on Rs 3-7 lakh i.e. the remaining Rs 4 lakh. Also, to make it more attractive, the government has given the benefit of two types of deductions.

1- Standard deduction

In the old tax system, salaried people get a standard deduction of Rs 50,000. That means no matter how much your salary is, you will not have to pay any tax on Rs 50,000. In the last budget, this was also included in the new tax system. In this way, you will not be taxed on a salary of up to Rs 7.50 lakh, not Rs 7 lakh, because Rs 50,000 will be reduced from your taxable income due to standard deduction.

2- Corporate National Pension System

You can get some additional exemptions over and above the standard deduction by making contribution to NPS through the employer. Apart from the exemption of Rs 1.5 lakh under 80CCD(1) and Rs 50,000 under 80CCD(1B), there is an additional exemption under 80CCD(2). Under this, you will get exemption on the investment made by the employer in your NPS. Employees of private companies can invest up to 10 percent of their basic salary in NPS. If you are a government employee, then this figure can be up to 14 percent for you.

How will ₹7.80 lakh become tax free?

Let’s assume that you have a package of Rs 7.80 lakh. In such a situation, your basic salary will be at least 50 percent of your CTC (₹3.90 lakh). In such a situation, you can invest 10 percent of it i.e. up to Rs 39 thousand in a corporate NPS account. A standard deduction of Rs 50 thousand will be available on Rs 7.80 lakh and tax exemption will be available on corporate NPS of Rs 39 thousand. In this way, you will get a total deduction of up to Rs 89,000, due to which your taxable income will be less than Rs 7 lakh (Rs 6.91 lakh) and your tax liability will be zero.

What do I have to do to get this discount?

Most companies provide the facility of NPS. You can talk to the HR of your company and get an investment made in NPS. This investment is made from your basic salary and the result will be that your in-hand salary will be reduced every month. The good thing will be that you will be able to get additional tax exemption. If your company does not have the facility of NPS, then talk to the HR once, they will guide you on this.