After the implementation of GST process, a large number of fake companies were registered without any business with the intention of fraud. On physical investigation, hundreds of registrations were found to be fake.

According to sources, many issues pending during the last three-four meetings will be discussed in this meeting. Rationalization of GST rates can also be considered.

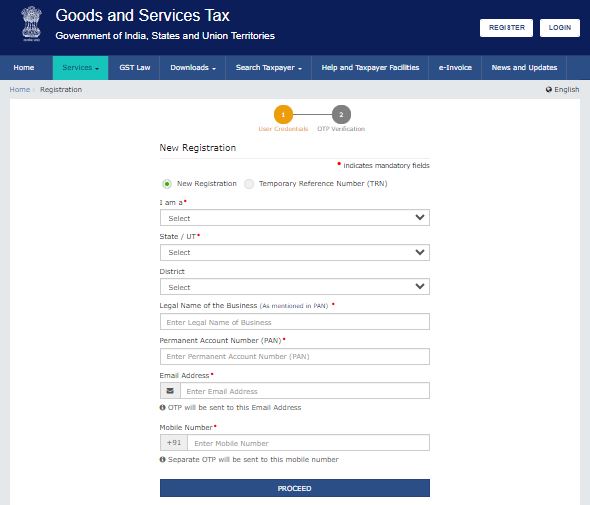

Biometric verification of Aadhaar can be made mandatory for new registration on the GST portal. A decision on this rule can be taken in the GST Council meeting to be held in New Delhi on June 22. If registration is done through biometric verification of Aadhaar, it will not be easy to commit fraud in the name of GST.

The next meeting will be very important

After the implementation of GST process, a large number of fake companies were registered without any business with the intention of fraud. Hundreds of registrations were found to be fake on physical investigation. Although even today one has to provide his Aadhaar number for GST registration, but biometric verification is not done now. The last meeting of the GST Council was held in October last year, so the meeting to be held on the coming Saturday is being considered very important.

Also Read: Delhi Property Tax: 10% discount will be given on paying property tax before 30 June in Delhi

According to sources, many pending issues of the last three-four meetings will be discussed in this meeting. Rationalization of GST rates can also be considered. Now the GST collection has crossed 1.5 lakh crores per month and this system has also become five years old. GST rates can also be increased on many items to rationalize the inverted duty.

GST may be reduced on health insurance

Last year, in view of the elections in many states and the Lok Sabha elections thereafter, the GST rates of many items were not changed in the council meeting despite the desire to do so. According to sources, the 18 percent GST on health insurance can be reduced to 5 percent.

This has been an old demand of health insurance companies and this will also make the purchase of health insurance cheaper. The council’s opinion can be taken on including petroleum products in the ambit of GST because the Petroleum Ministry has already recommended bringing aviation fuel and gas under the ambit of GST many years ago.

However, any decision on this is very difficult at the moment, because no state is ready for this. Actually, petroleum is a big medium for the governments to collect revenue. Online gaming companies have also requested the council to reduce the GST rate of 28 percent on online gaming. Companies say that their costs have increased after the imposition of GST at the rate of 28 percent in October last year.