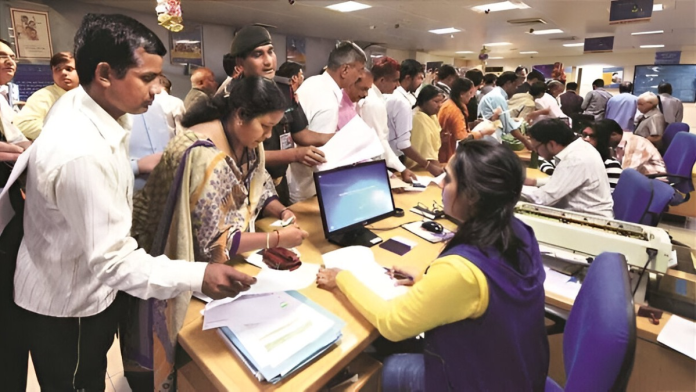

What is Banking Laws Amendment Bill: Banking Amendment Bill 2024 has been passed in the Lok Sabha. While presenting the bill, Finance Minister Nirmala Sitharaman discussed its 19 amendments.

After the passage of this bill, bank account holders will see many changes from bank account to FD. This amendment was passed for the convenience of the customers and to make the banking system more simple. Along with this, there will be major changes in the banking rules.

Now you can add 4 nominees

After the Banking Law Amendment Bill 2024 is passed in the Lok Sabha, account holders will get the right to add 4 nominees instead of one in their bank account and FD. Till now you had the option of adding one nominee in your account or FD, but now after the passage of this bill, the number of nominees has been increased to 4. Let us tell you that this change in the rules is being made to transfer the unclaimed amount to the rightful heir. According to the data of the Reserve Bank of India, till March 2024, about Rs 78,000 crore is lying in the banks as unclaimed amount.

You will get these two options to add a nominee

Under the Banking Laws (Amendment) Bill, 2024 passed in the Lok Sabha, account holders can add a maximum of four nominees to their accounts. There will be methods for this. Under the first method, all the nominees will have to give a fixed share together. That is, you can decide who has to give how much share. You can add their names accordingly.

The second way is to keep the nominees in a sequence. In this way, the nominees will receive the money one after the other. You can choose either of the two options as per your convenience. The new rule will make it easier for the account holder’s family to access the money, while the delay in the bank process is also expected to reduce.

Central Co-operative Banks will be able to work in State Co-operative Banks as well

According to the new bill, now the directors of the Central Co-operative Bank will also be able to work in the State Co-operative Bank. In the bill, the tenure of the directors of co-operative banks has been increased from 8 years to 10 years. However, this rule will not apply to the chairman and whole-time directors. Under this bill, government banks will get the right to decide the fees of auditors and hire top level talent.

The rules for reporting will change

Under the new rule, the time limit for submitting the report to RBI by the banks has been changed, under the new rule now banks can submit the report to RBI in 15 days, one month and at the end of the quarter. Let us tell you that currently banks had to submit the report to RBI every Friday.

Facility to transfer to conservation fund

Apart from this, under the new bill, the amount of dividend, shares, interest and matured bonds which are not claimed for 7 years will be transferred to Investor Education and Protection Fund.